unlevered free cash flow vs fcff

FCFF vs FCFE FCFF vs FCFE Existují dva typy volných peněžních toků. Unlevered Cash Flow if mentioned on the Balance Sheet comes with a disclosure.

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Difference Between FCFF vs FCFE.

. Levered Free Cash Flow vs Unlevered Free Cash Flow. If Unlevered Free Cash Flows are being used the firms Weighted Average Cost of Capital WACC. Levered Cash Flow appears on the Balance Sheet in most cases.

Unlevered FCF FCFF. Notice that the free cash flows available to the common stockholders The Common Stockholders A stockholder is a person company or institution who owns one or more shares of a company. Free Cash Flow to Firm is cash flow available to the whole firm or enterprise hence the derived value is the enterprise value.

Cash flow is available to all the investors of a firm. It is vital to understand FCFF vs. DCF Implications for Both.

If the company is not paying dividends. The look thru rule gave qualifying US. FCFF vs FCFE FCFF vs FCFE There are two types of Free Cash Flow.

They are the companys owners but their liability is limited to the value of their shares. Cash flow is available for equity shareholders only. Levered Free Cash Flow is the amount that is available to the shareholders since all debt obligations have been paid out.

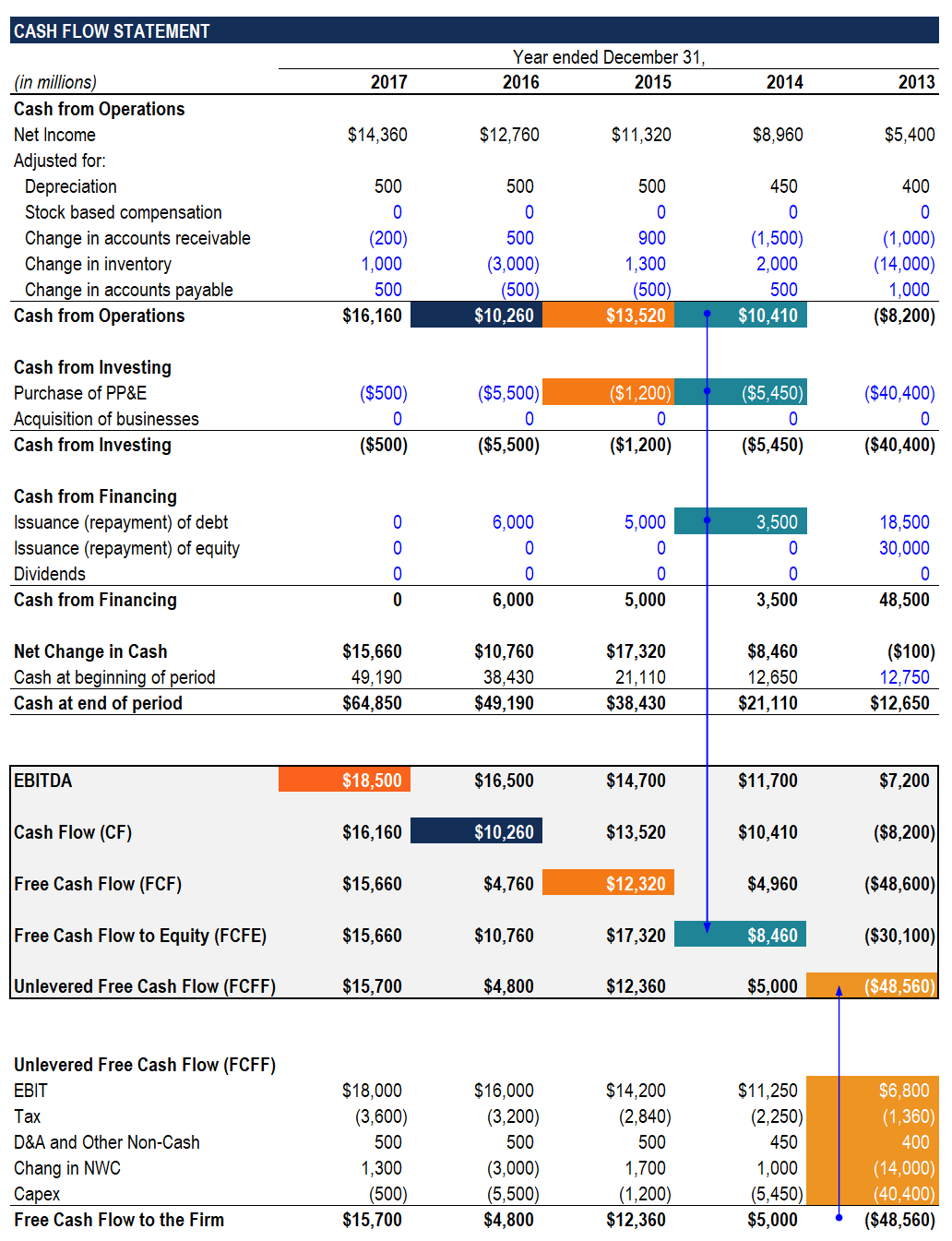

Read more are less than those available before paying the debtors. It is the cash flow available to all equity holders and debtholders after all operating expenses capital expenditures and investments in working capital have been made. Analysts like to use free cash flow either FCFF or FCFE as the return.

Unlevered free cash flow can be reported in a companys. Unlevered Free Cash Flow also known as Free Cash Flow to the Firm or FCFF for short is a theoretical cash flow figure for a business. Negative value of unlevered free cash flow UCF.

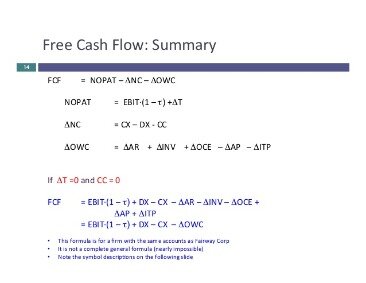

The major differences between free cash flow to firm FCFF and free cash flow to equity FCFE are as follows. Unlevered free cash flow UFCF or FCFF can be defined as the amount of cash a company has with no debt payments to be made. Free Cash Flow to Firm FCFF Formula EBIT FCFF To calculate FCFF starting from earnings before interest and taxes we begin by adjusting EBIT for taxesEBIT is an unlevered profit measure since it is above the interest expense line and does not include outflows specific to one capital provider group eg lenders.

Free Cash Flow to Firm FCFF commonly referred to as Unlevered Free Cash Flow. Unlevered Free Cash Flow. Unlevered Free Cash Flow - UFCF.

Unlevered free cash flow is generated by the enterprise so its present value like an EBITDA multiple will give you the Enterprise value. FCFF vs FCFE FCFF vs FCFE Existují dva typy volných peněžních toků. The FCFF and FCFE which are acronyms for Free Cash Flow for the Firm and Free Cash Flow to Equity are the two types of free cash flow measures.

FCFF unlevered free cash flow. The FCFF is a pre-debt cash flow. Volný hotovostní tok do firmy FCFF běžně označovaný jako Unlevered Free Cash Flow.

Levered beta contains the risk related to equity holder and debt holder Similarly FCFF is the one considering both equity and debt. The difference between the two can be traced to the fact that Free Cash Flow to Firm excludes the impact of. Unlevered Free Cash Flow aka free cash flow to the firm FCFF Unlevered Free Cash Flow is also known as Free Cash Flow to the Firm FCFF.

FCFF 1532 million. The free cash flow to equity will always be higher than cash flow to the firm because the latter is a pre-debt cash flow. A Free Cash Flow to Equity FCFE běžně označované jako Levered Free Cash Flow.

UNLEVERED Free Cash Flow or Free Cash Flow to the Firm FCFF is the cash flow available to the firm to remunerate BOTH shareholders and bondholders. Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account. FCFE because the numerator and discount rate of multiples largely depend on the methods of cash flow used.

And Free Cash Flow to Equity FCFE or Unlevered Free Cash Flow vs Levered Free Cash Flow. Internal Revenue Code that lowered taxes for many US. FCFF Free Cash Flow to Firm Unlevered Free Cash Flow UFCF The value of the entire firm or enterprise Used to value the entire firm with a WACC as the discount rate stockholders bondholders and preferred stockholders if applicable.

FCFF is the cash flow available for discretionary distribution to all investors of a company both equity and debt after paying for cash operating expenses and capital expenditureSince interest payments or leverage effects are not taken into consideration in the computation of FCFF this measure is also referred to as an unlevered cash flow. What is Unlevered Free Cash Flow UFCF. Just like valuation multiples differ depending on the type of cash flow being used the discount rate in a DCF also differs depending on whether Unlevered Free Cash Flows or Levered Free Cash Flows are being discounted.

Unlevered cash flow as leverage impact is excluded. The idea is that unlevered free cash flow excludes all impacts of debt on cash flow including interest and the tax benefits of interest expense. FCFF is the academic label and unlevered free cash flow is what you would call it in banking.

Je důležité chápat rozdíl mezi FCFF a FCFE jako diskontní sazbou a čitatelem ocenění. That is why we DO NOT subtract interests even though they are tax deductibile like depreciations. Levered Free Cash Flow.

It is the cash flow available to all equity holders and debtholders after all operating expenses capital expenditures and investments in working capital have been made. Why does it bear this name. Levered cash flow as leverage impact is included.

UFCF is the cash that is freely available to all capital providers. And Free Cash Flow to Equity FCFE or Unlevered Free Cash Flow vs Levered Free Cash Flow. In the long term it can be equal to but it cannot be lower than the FCFE.

Free cash flow to the firm FCFF and free cash flow to equity FCFE are the cash flows available to respectively all of the investors in the company and to common stockholders. Finance professionals know Unlevered Free Cash Flow as Free Cash Flow to the Firm or FCFF for short. Unlevered free cash flow is used in DCF valuations or debt capacity analysis in highly leveraged transactions to establish the total cash generated by a business for both debt and equity holders.

Used interchangeably with unlevered free cash flow the FCFF metric accounts for all recurring operating expenses and re-investment expenditures while excluding all outflows related to. A complex provision defined in section 954c6 of the US. FCFE levered free cash flow.

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow To Firm Fcff Formulas Definition Example

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

What Is The Difference Between Free Cash Flow To Equity And Free Cash Flow To Firm Quora

Free Cash Flow To Firm Fcff Unlevered Fcf Formula And Excel Calculator

Fcf Yield Unlevered Vs Levered Formula And Calculator

Fcff Vs Fcfe Differences Valuation Multiples Discount Rates

Fcff Vs Fcfe Differences Valuation Multiples Discount Rates

Levered Vs Unlevered Free Cash Flow Difference Wall Street Oasis

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Fcf Most Important Metric In Finance Valuation

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-03-2c4a6ea86c4b4b13b8a440cee78fac7d.jpg)

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)