do nonprofits pay taxes on lottery winnings

When you win a prize your winnings will be yours without paying anything. Only two states out of the 43 states that participate in multistate lottery taxes from non-residents.

Get Your Free Lottery Ticket From Icelotto For A Limited Time Freebies Com The Best Other Free Sampl Lottery Tickets Online Lottery Winning Lottery Ticket

The tax rate will be determined by your income.

. The IRS takes 25 percent of lottery winnings from the start. You can claim an itemized deduction for the amount of your wager only to. The rest of your tax bill comes when you file your next tax return.

Any money from winning the National Lottery will incur no capital gains tax or extra-national insurance too. The income tax regulations specify that income although not actually. How Much Tax Do You Pay On Lottery Winnings In Canada.

Technically lottery winnings are classed as gambling winnings which means lottery winners wont need to pay income tax on their lottery cash. HM Revenue Customs doesnt regard lottery winnings as income so all prizes are tax-free hurray. You would only pay 50 of tax when you filed a tax return.

Tax on winnings should be reported to you in Box 1 reportable winnings of IRS Form W-2G. That raises your total ordinary taxable income to 145000 with 25000 withheld from your winnings for federal taxes. In fact of the 43 states that participate in multistate lotteries only two withhold taxes from nonresidents.

Before the winner receives any of the money however the IRS automatically takes 24 of the winnings. Lottery winnings are considered ordinary taxable income for both federal and state tax purposes. However there could be tax implications once youve banked your winnings.

For this reason many nonprofits raise money by conducting gambling also called gaming activities such as bingo lotteries raffles pull-tabs punch boards tip boards pickle. The lottery agency will report the money on Form W-2G if its over 600 and withhold from it as well. It isnt a problem to pay no VAT on lottery winnings in the UK whether its the regular lottery tickets or scratch cards Euromillions or even lottery tickets with prizes.

Even if your estate is divided evenly between heirs inheritance tax could. As soon as you have won the drawing and have the right to the winnings you have income that is subject to tax. Right off the bat lottery agencies are required to withhold 24 from winnings of 5000 or more which goes to the federal government.

This is because Texas does not levy taxes on lottery winnings. The same tax liability from winning New York State lottery games also applies to multi-state games such as Mega Millions and Powerball. However its not all tax-free you may need to pay inheritance taxes if your winnings.

When the lottery winner does reside in a specific state then most of the states in the USA do not withhold lottery tax by state. This could be because Texas does not have a state income tax but either way they do not tax winnings. Most states dont withhold taxes when the winner doesnt reside there.

Those rates apply whether you choose to take winnings in a lump sum or annuity. Theyre not in most countries. These states are Maryland and Arizona.

The key to avoiding income taxes is to give the ticket or an interest in the ticket to the charity before the drawing and before you are entitled to the winnings. The IRS noted that the income tax regulations require income to be taxed that is either actually or constructively received. Arizona and Maryland both tax the winnings of people who live out-of-state.

You might not realize it but if you win the lottery you wont be handed a check for the full amount. Canada does not tax international winners of lottery winnings. However a nonresident of Wisconsin must have Wisconsin gross income including any Wisconsin lottery winnings of 2000 or more before the nonresident is required to file a Wisconsin income tax return and pay Wisconsin income tax on the lottery winnings.

I think its weird that lottery winnings are taxed in the US. Because of this its impossible to donate lottery money tax-free to a charity since 25 percent of the cash has already been forwarded to the IRS and you must report the entire award as income on your tax return. The organization reports the grossed up amount of the prize fair market value of prize plus amount of taxes paid on behalf of winner in box 1 of Form W.

This includes lottery winnings sweepstakes you entered by making a wager church raffle tickets or charity drawings. Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense. To prevent abuses and tax evasion the IRS imposes strict requirements on nonprofits that make money through gambling events.

The IRS ruled that the husband and wife would be taxed on the full amount of the lottery winnings even the portion that they attempted to give away. Gambling is legal and you cannot be taxed on any profit made by purchasing a lottery ticket. But if the Pool members were entitled to the winnings when they made the nonprofit a member of the Pool they will be taxed on the winnings and will deduct the value of the contribution as a partial offset.

37 on any amount more than 523601. The rest of the winnings are. Keep in mind that just because you will not have to pay taxes on your lottery winnings in Texas if you live in another state you may be liable to pay taxes in your state.

This payment must in effect be paid as a Canadian currency donation. This is because 25 2500 in federal tax and 5 500 in Massachusetts tax is taken out. 35 on the next 314174.

You can offset that to some extent by giving to charity but you may not be able to offset it entirely. Many people love to gamble especially when its for a good cause. In other words say you make 45000 a year and you won 100000 in the lottery.

32 on the next 44499. Unlike US lotteries lottery winnings dont appear to be taxable in Canada. When you cash out your winnings with the Lottery you will receive 7000.

That means the federal tax rate of 24 will immediately be withheld along with the highest New York state tax rate of 882. Taxes on Lottery Winnings Raffles Charity Drawings and Sweepstakes by Wager. Can I change the amount of tax the lottery withholds.

So even if you could direct your winnings into a trust fund to avoid paying taxes that 25 percent would be withheld. Having said that lets go over this again. Under this formula the organization must pay withholding tax of 3333 of the prizes fair market value.

But depending on whether your winnings affect your tax bracket there could potentially be a gap between the mandatory withholding amount and what youll ultimately owe the IRS. Winnings are taxed the same as wages or salaries are and the total amount the winner receives must be reported on their tax return each year. How much taxes do you pay on 1000.

The nonprofit doesnt have to pay tax on either lottery winnings that it paid for or on contributions from the Pool members. Thats because you are not actually making a charitable donation but are gambling on the chance that you have the winning ticket.

Lottery Winners Pour Millions Into Nonprofits Make Diversity A Priority

Preparing A Client To Claim A Lottery Jackpot Wsj

I Won 1 Million Dollars At An Illegal Poker Game How Do I Spend This Money Without The Irs Finding Out Quora

State Forms Online Catalog In Gov

Rules For Charitable Gaming Activities Thompson Greenspon Cpa

Michigan Should Eliminate Its Asset Limit For Food Assistance Mlpp

One More Thing To Do When You Win The Lottery

One More Thing To Do When You Win The Lottery

Powerball Winning Numbers For Wednesday January 5 2022 630m Jackpot

New Missouri Law Makes It A Crime To Reveal Lottery Winners Politics Wsiltv Com

Tico Sentenced To 4 Years In U S Prison In Sweepstakes Scam Q Costa Rica

Enabling Deep Negative Rates To Fight Recessions A Guide In Imf Working Papers Volume 2019 Issue 084 2019

Alaska Lottery Guide To Ak Lotto Numers Games

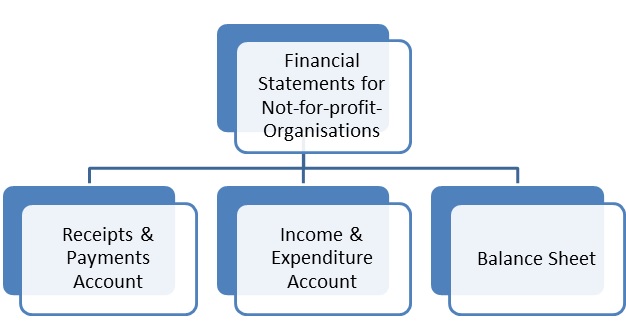

Financial Statements Of Non Profit Organisations How To Earn Money Through Small Savings